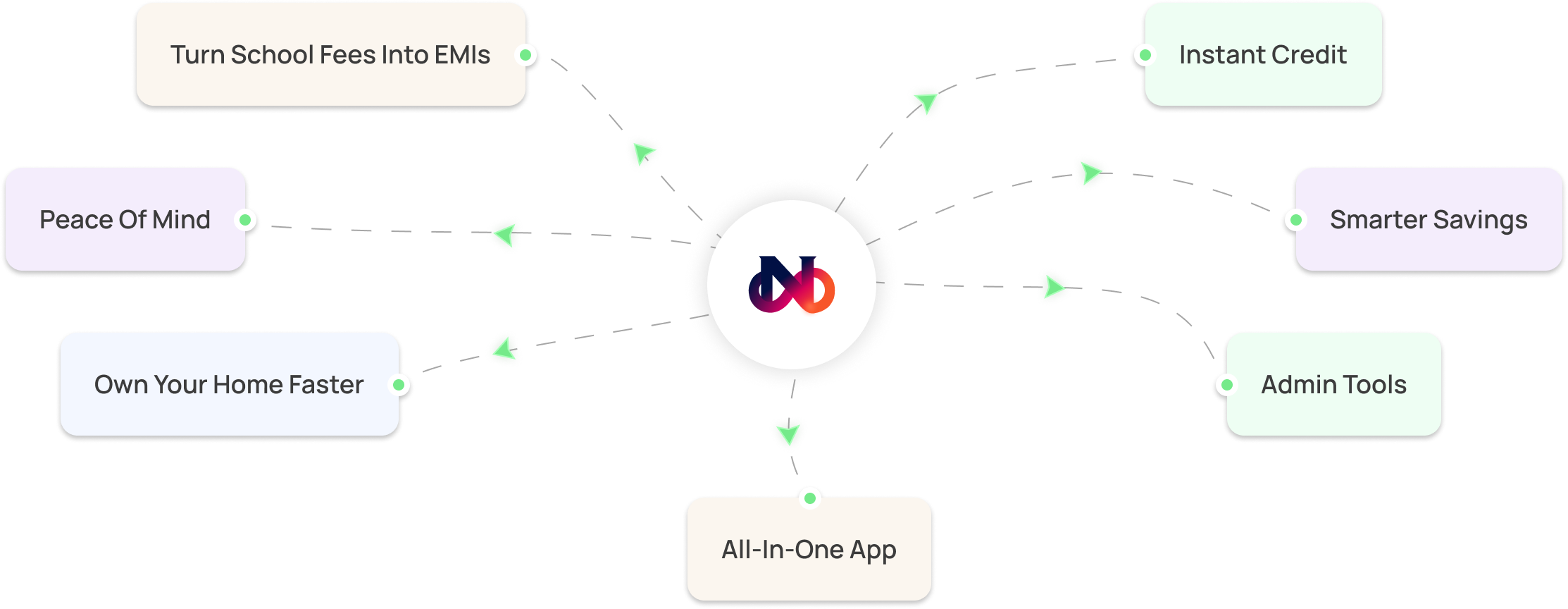

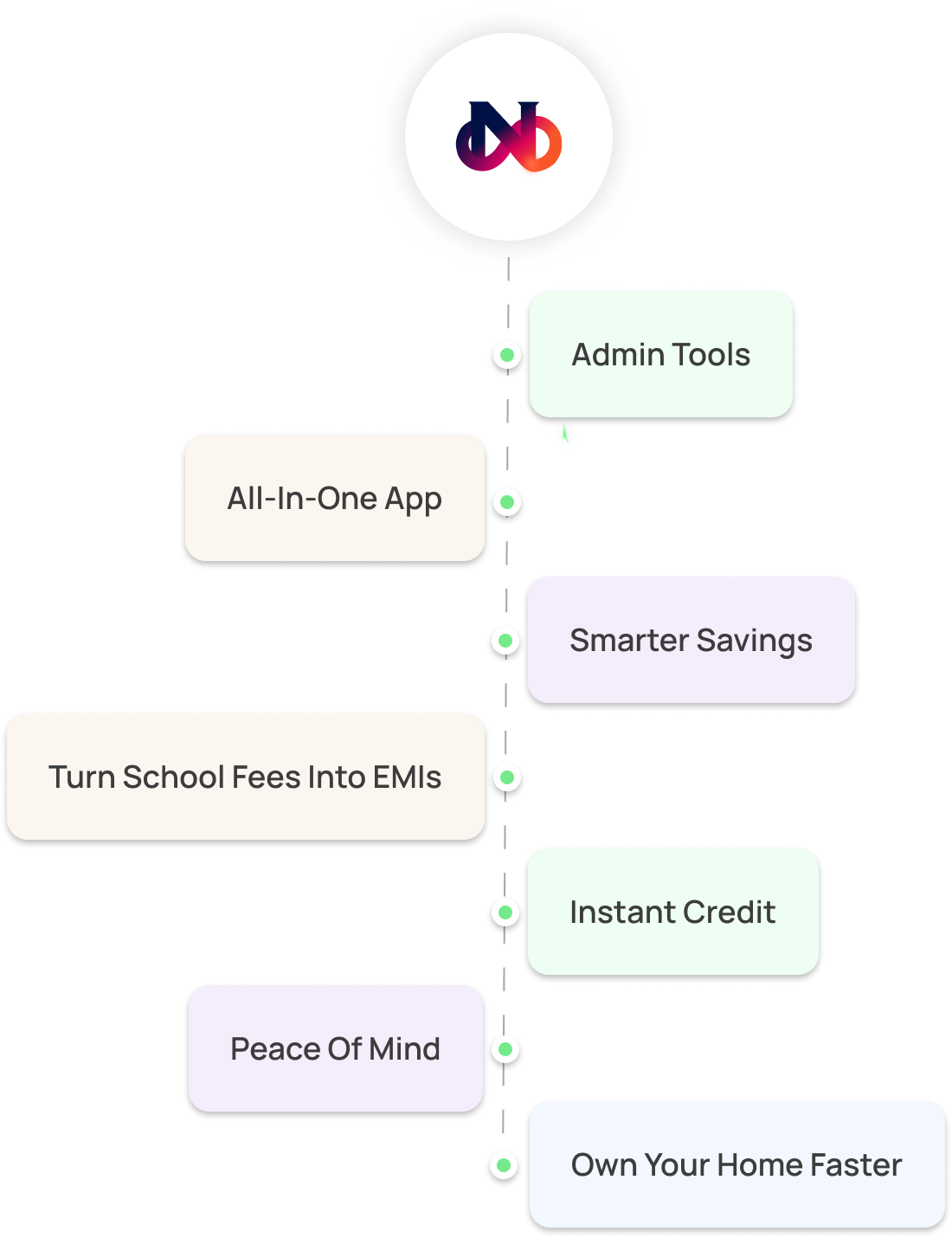

INDIA’S FIRST HYBRID

Finance, Property, Freedom

Together.

Get home loans, school EMIs, instant credit, and goal-based savings

— all in one seamless and powerful

app experience.

Real Estate + Loan

Buy flats with instant loan bundle

School EMI Zone

Convert fees to low cost EMIs

Hospital EMI Zone

Convert bills into low-cost EMIs

Smart Vault

Save small to reach big goals

Instant Credit

BNPL, personal loan in one tap

Digital Agreements

Create and sign rent or fee contracts

Scan & Pay Bills

Pay instantly via UPI or QR code

Admin Dashboards

Monitor fees, rent, and collections

Own Account No

Choose your own account number